Happy Friday everyone!

Man, this was a busy week; "what happened again?"

Better to be busy, than not, so I'll keep going and update on where mortgage rates sit. And, provide a glimpse into where they might be going.

Here goes!

Check out this chart.

|

3 Month Mortgage Bond Price Chart

|

What is important about this chart? What the heck does it mean?

Remember, as prices on mortgage bonds go down, mortgage rates go up -- and vice versa.

The blue line is the 200 day moving average. As you can clearly see, we have fallen WAY below it.

The red line is the 25 day moving average and over the past 10 trading days this has been acting like a magnet on price. I like it. I like it because I see technical strength being built. A new key price floor is, hopefully, become strong.

The Federal Reserve will have a lot of money in hand from recent prepayments on mortgages that were just paid off on a refinance. They will put that money back to work in buying the current market. None of their communications have indicated that this practice will end.

For a refresher, the Federal Reserve's Quantitative Easing is accounting for $85 billion in open market bond purchases. $45 billion of this is in U.S. Treasuries. The remaining $40 billion in mortgage-backed securities. The monthly amount of of rollovers from early prepayments is estimated at $20-50 billion. A lot of money.

The Federal Reserve is now changing their dialogue to discuss a possible lowering of the unemployment target of 6.5% to something like 6.0%, or 5.5%. This is another way they can adjust and continue to monetary stimulus.

Rates Will Do...?

The way I read the technical picture, and my gut feel, is that we will see a rise in price from the 25 day moving average area and get to 103 basis points (bps) before serious price resistance kicks in. That gives a possible 200 basis points at hand. Such a move may translate into a 0.5% lower 30 year fixed rate.

You know, that seems even more plausible as that'd take the 30 year fixed rate to near 4.0%, a key psychological level.

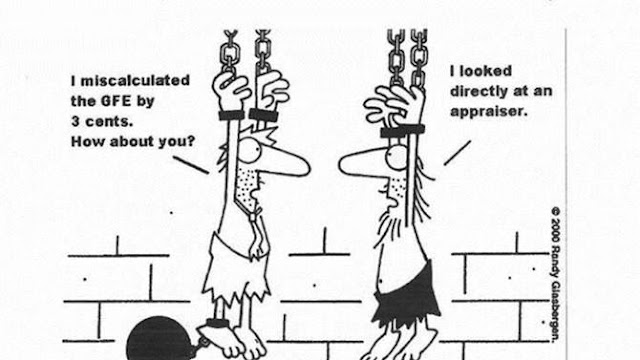

This is how it feels as a loan originator these days:

You know, sometimes it feels like I'm always guiding my clients through an ever-changing maze. At least I feel confident that I have a good feel on predicting the twists and turns so that we can execute through them. When a client's home purchase is on the line, making sure we close smoothly and on time is what I'm thinking.

The cartoon above lets you know the humor you need or mortgage finance may drive you crazy these days!

Do you know anyone thinking about buying a home? If so, please introduce us as I'm never too busy to help lend a hand. My business is primarily from the introductions by past clients like you.

Have a fantastic weekend!

Brett

How To Contact Me