Quick note, we have changed our focus to the FNMA 4.0% coupon for gauging mortgage-backed securities trading, and mortgage rates.

Just a few months ago we were watching the 3.0% coupon, then to the 3.5% one and now stair-stepping up again.

BG

Wednesday, July 31, 2013

Tuesday, July 30, 2013

Update on Mortgage Bonds

Quick update with a chart (below) on mortgage bonds.

Price is stable and the trading range is narrowing before we get news from the Federal Reserve on Wednesday and the monthly Jobs Report looms on Friday.

Where will we go from here? The news of the week will likely be the catalyst now.

If we get an upward break from here we should see a little room to run higher and, subsequently, some lower mortgage rates for a few weeks.

Brett

How To Contact Me

Price is stable and the trading range is narrowing before we get news from the Federal Reserve on Wednesday and the monthly Jobs Report looms on Friday.

Where will we go from here? The news of the week will likely be the catalyst now.

|

| 3 Month Price Chart on Mortgage Bonds (FNMA 3.5% coupon) |

If we get an upward break from here we should see a little room to run higher and, subsequently, some lower mortgage rates for a few weeks.

Brett

How To Contact Me

Friday, July 26, 2013

Mortgage Rates. Here they are, but where are they going?

Happy Friday everyone!

Man, this was a busy week; "what happened again?"

Better to be busy, than not, so I'll keep going and update on where mortgage rates sit. And, provide a glimpse into where they might be going.

Here goes!

Check out this chart.

What is important about this chart? What the heck does it mean?

Remember, as prices on mortgage bonds go down, mortgage rates go up -- and vice versa.

The blue line is the 200 day moving average. As you can clearly see, we have fallen WAY below it.

The red line is the 25 day moving average and over the past 10 trading days this has been acting like a magnet on price. I like it. I like it because I see technical strength being built. A new key price floor is, hopefully, become strong.

The Federal Reserve will have a lot of money in hand from recent prepayments on mortgages that were just paid off on a refinance. They will put that money back to work in buying the current market. None of their communications have indicated that this practice will end.

For a refresher, the Federal Reserve's Quantitative Easing is accounting for $85 billion in open market bond purchases. $45 billion of this is in U.S. Treasuries. The remaining $40 billion in mortgage-backed securities. The monthly amount of of rollovers from early prepayments is estimated at $20-50 billion. A lot of money.

The Federal Reserve is now changing their dialogue to discuss a possible lowering of the unemployment target of 6.5% to something like 6.0%, or 5.5%. This is another way they can adjust and continue to monetary stimulus.

Rates Will Do...?

The way I read the technical picture, and my gut feel, is that we will see a rise in price from the 25 day moving average area and get to 103 basis points (bps) before serious price resistance kicks in. That gives a possible 200 basis points at hand. Such a move may translate into a 0.5% lower 30 year fixed rate.

You know, that seems even more plausible as that'd take the 30 year fixed rate to near 4.0%, a key psychological level.

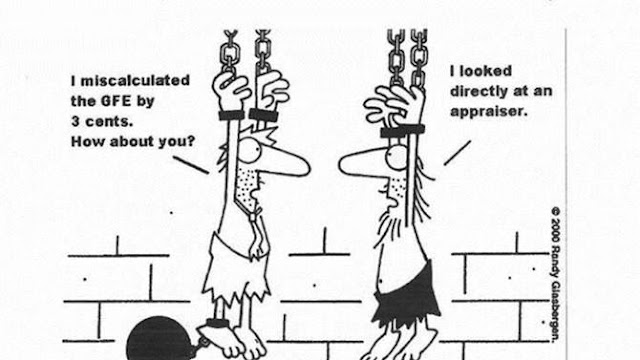

This is how it feels as a loan originator these days:

You know, sometimes it feels like I'm always guiding my clients through an ever-changing maze. At least I feel confident that I have a good feel on predicting the twists and turns so that we can execute through them. When a client's home purchase is on the line, making sure we close smoothly and on time is what I'm thinking.

The cartoon above lets you know the humor you need or mortgage finance may drive you crazy these days!

Do you know anyone thinking about buying a home? If so, please introduce us as I'm never too busy to help lend a hand. My business is primarily from the introductions by past clients like you.

Have a fantastic weekend!

Brett

How To Contact Me

Man, this was a busy week; "what happened again?"

Better to be busy, than not, so I'll keep going and update on where mortgage rates sit. And, provide a glimpse into where they might be going.

Here goes!

Check out this chart.

|

| 3 Month Mortgage Bond Price Chart |

What is important about this chart? What the heck does it mean?

Remember, as prices on mortgage bonds go down, mortgage rates go up -- and vice versa.

The blue line is the 200 day moving average. As you can clearly see, we have fallen WAY below it.

The red line is the 25 day moving average and over the past 10 trading days this has been acting like a magnet on price. I like it. I like it because I see technical strength being built. A new key price floor is, hopefully, become strong.

The Federal Reserve will have a lot of money in hand from recent prepayments on mortgages that were just paid off on a refinance. They will put that money back to work in buying the current market. None of their communications have indicated that this practice will end.

For a refresher, the Federal Reserve's Quantitative Easing is accounting for $85 billion in open market bond purchases. $45 billion of this is in U.S. Treasuries. The remaining $40 billion in mortgage-backed securities. The monthly amount of of rollovers from early prepayments is estimated at $20-50 billion. A lot of money.

The Federal Reserve is now changing their dialogue to discuss a possible lowering of the unemployment target of 6.5% to something like 6.0%, or 5.5%. This is another way they can adjust and continue to monetary stimulus.

Rates Will Do...?

The way I read the technical picture, and my gut feel, is that we will see a rise in price from the 25 day moving average area and get to 103 basis points (bps) before serious price resistance kicks in. That gives a possible 200 basis points at hand. Such a move may translate into a 0.5% lower 30 year fixed rate.

You know, that seems even more plausible as that'd take the 30 year fixed rate to near 4.0%, a key psychological level.

This is how it feels as a loan originator these days:

You know, sometimes it feels like I'm always guiding my clients through an ever-changing maze. At least I feel confident that I have a good feel on predicting the twists and turns so that we can execute through them. When a client's home purchase is on the line, making sure we close smoothly and on time is what I'm thinking.

The cartoon above lets you know the humor you need or mortgage finance may drive you crazy these days!

Do you know anyone thinking about buying a home? If so, please introduce us as I'm never too busy to help lend a hand. My business is primarily from the introductions by past clients like you.

Have a fantastic weekend!

Brett

How To Contact Me

Monday, July 8, 2013

The Lowest Unemployment City is Minneapolis

Good morning!

Welcome back from the 4th of July holiday. I hope you built some great memories. Mine include two fireworks shows from equally impressive vantage points. My young son saying "I just don't know where to look!" as we could see 10 separate shows going off across the metro area. The second from a river bluff over the St. Croix river where the fireworks were right in front of us. Wow!

Add in a drive in movie last night to cap the long weekend off!

Check out this article in Slate where we find that Minneapolis has the lowest unemployment rate for any city with a population over one million people in the United States.

http://www.slate.com/blogs/moneybox/2013/07/03/you_should_move_to_minneapolis_lowest_unemployment_big_city_in_america.html

This is great news for our local economy and, in turn, the housing market.

Have a great week!

Brett

How to Contact Me

Welcome back from the 4th of July holiday. I hope you built some great memories. Mine include two fireworks shows from equally impressive vantage points. My young son saying "I just don't know where to look!" as we could see 10 separate shows going off across the metro area. The second from a river bluff over the St. Croix river where the fireworks were right in front of us. Wow!

Add in a drive in movie last night to cap the long weekend off!

Check out this article in Slate where we find that Minneapolis has the lowest unemployment rate for any city with a population over one million people in the United States.

http://www.slate.com/blogs/moneybox/2013/07/03/you_should_move_to_minneapolis_lowest_unemployment_big_city_in_america.html

This is great news for our local economy and, in turn, the housing market.

Have a great week!

Brett

How to Contact Me

Friday, July 5, 2013

Mortgage Rates Headed Higher

Here we are on what would normally be a light day of financial news but after the release of the strong than expected June Jobs Report mortgage bonds are getting creamed!

As I type I see the Fannie Mae 3.5% coupon trading down 194 basis points in price. Ugh. Just looking at this chart (see below) makes me want to close my laptop.

When will this carnage end? Hard to say as we continue to blow through expected levels of price support.

The continued downslide in price (move higher in rates) continues to cement in what I thought weeks ago. What was that?

That the end of the secular (11 year run) for lower and lower mortgage rates is now done. Finished.

So, while it might take a little while to accept this reality accept it we must.

Don't let hope for a return to lower rates misguide your thinking. The odds are severely stacked against it.

I'll continue to watch the trading and inform you here as we will eventually find price support somewhere.

Until then, enjoy the holiday weekend and the growing strength in the housing market that we are seeing in the data.

Brett

Get In Touch With Me Here

As I type I see the Fannie Mae 3.5% coupon trading down 194 basis points in price. Ugh. Just looking at this chart (see below) makes me want to close my laptop.

When will this carnage end? Hard to say as we continue to blow through expected levels of price support.

The continued downslide in price (move higher in rates) continues to cement in what I thought weeks ago. What was that?

That the end of the secular (11 year run) for lower and lower mortgage rates is now done. Finished.

So, while it might take a little while to accept this reality accept it we must.

Don't let hope for a return to lower rates misguide your thinking. The odds are severely stacked against it.

I'll continue to watch the trading and inform you here as we will eventually find price support somewhere.

Until then, enjoy the holiday weekend and the growing strength in the housing market that we are seeing in the data.

Brett

Get In Touch With Me Here

Tuesday, July 2, 2013

Median Home Mortgage Rate History

Good morning,

The office, the roads and the coffee shop sure are lighter as many people are already off on vacation for the 4th of July holiday.

I was doing some research on mortgage rates. So many conversations with people the past few weeks have been "what happened and will now happen" to mortgage rates. We just saw the conforming 30 year fixed rate mortgage move from around 3.5% to 4.5%.

The 3's for the 30 year fixed rate mortgage look to be gone for years to come.

But, is 4.5% really that high? Yes, it seems so in comparison to a 3.5% rate but let's take a longer view of history.

The median mortgage rate for the past 10 years is 5.72%.

The median mortgage rate for the past 20 years is 6.52%.

The median mortgage rate for the past 30 years is 7.45%.

And, for the past 40 years that median rate is 8.15%.

So, a 4.5% rate is still low by historical standards. Instead of being too upset that the 3's are no longer available we should still be thankful to have rates lower than most time in history.

Now, some mortgage humor. If you have been in the mortgage business for a long time, like me, this cartoon is laugh out loud funny in depicting what the business has become the past few years.

Brett

How to Contact Me

The office, the roads and the coffee shop sure are lighter as many people are already off on vacation for the 4th of July holiday.

I was doing some research on mortgage rates. So many conversations with people the past few weeks have been "what happened and will now happen" to mortgage rates. We just saw the conforming 30 year fixed rate mortgage move from around 3.5% to 4.5%.

The 3's for the 30 year fixed rate mortgage look to be gone for years to come.

But, is 4.5% really that high? Yes, it seems so in comparison to a 3.5% rate but let's take a longer view of history.

The median mortgage rate for the past 10 years is 5.72%.

The median mortgage rate for the past 20 years is 6.52%.

The median mortgage rate for the past 30 years is 7.45%.

And, for the past 40 years that median rate is 8.15%.

So, a 4.5% rate is still low by historical standards. Instead of being too upset that the 3's are no longer available we should still be thankful to have rates lower than most time in history.

Now, some mortgage humor. If you have been in the mortgage business for a long time, like me, this cartoon is laugh out loud funny in depicting what the business has become the past few years.

Brett

How to Contact Me

Monday, July 1, 2013

New Mortgage Payment Relief on the Way

More U.S. homeowners struggling to make their mortgage payments will receive relief soon through the Streamlined Modification Program.

These are for borrowers whose loans are with Fannie Mae and Freddie Mac.

Read this article for more details.

http://money.cnn.com/2013/07/01/real_estate/mortgage-payments/index.html?hpt=hp_t3

These are for borrowers whose loans are with Fannie Mae and Freddie Mac.

Read this article for more details.

http://money.cnn.com/2013/07/01/real_estate/mortgage-payments/index.html?hpt=hp_t3

Subscribe to:

Comments (Atom)